Musk’s Everything Play

Posted February 17, 2026

Chris Campbell

There are two kinds of CEOs.

One holds an earnings call. The other holds a meeting about installing a magnetic cannon on the Moon.

Guess which one we’re discussing.

Last week, a group of twenty-something engineers from xAI—faces lit by GPU glow—joined Elon Musk to explain how they assembled the largest AI cluster on Earth.

The company, we are reminded, is two and a half years old.

A toddler.

Toddlers normally master the spoon.

This one assembled 100,000 H100s… then began scaling toward a million.

Grok. Voice. Reasoning. Forecasting. Everyone becomes a coder. You specify the outcome. The AI will emit optimized binary.

From there, anything is possible.

Robotaxis. Orbital data centers. Real-time generative worlds. Encyclopedia Galactica. Lunar factories. Global communications stack.

All impressive. All cinematic.

But the one detail that didn’t involve railguns or terawatts?

Money.

X Money, specifically.

While everyone stares at rockets and GPUs, Musk is quietly circling the most boring, most profitable industry on Earth.

Let’s dive in…

What X Money Actually Is

Forget “everything app.” (For now.)

Here’s what we know:

- X built a payments arm, X Payments LLC.

- It pursued state-by-state money transmitter licenses (40+ approvals by mid-2025).

- It partnered with Visa to power instant wallet funding and debit-linked P2P.

- As of early 2026, it’s in closed beta.

Translation: X Money is a regulated stored-value wallet sitting on top of Visa push rails.

Not a bank. Not magic.

On the surface, it’s basically Venmo inside X.

On the surface.

Step One: Payments

Payments are the glue.

Every super-app in history—from WeChat to Grab—used payments to:

- Increase daily habit

- Anchor identity

- Reduce churn

- Expand into commerce

If X can get users to hold balances inside the app, it changes how people behave on X:

- Creators get paid instantly.

- Users tip, transact, subscribe.

- Commerce happens natively.

- The ad model becomes secondary.

Money becomes retention infrastructure.

That’s the first step.

Step Two? Everything Else

X is also preparing to let users trade stocks and crypto directly inside the feed.

Scroll, argue, click a ticker, buy a share. No need to leave the coliseum. The arena now contains the cashier.

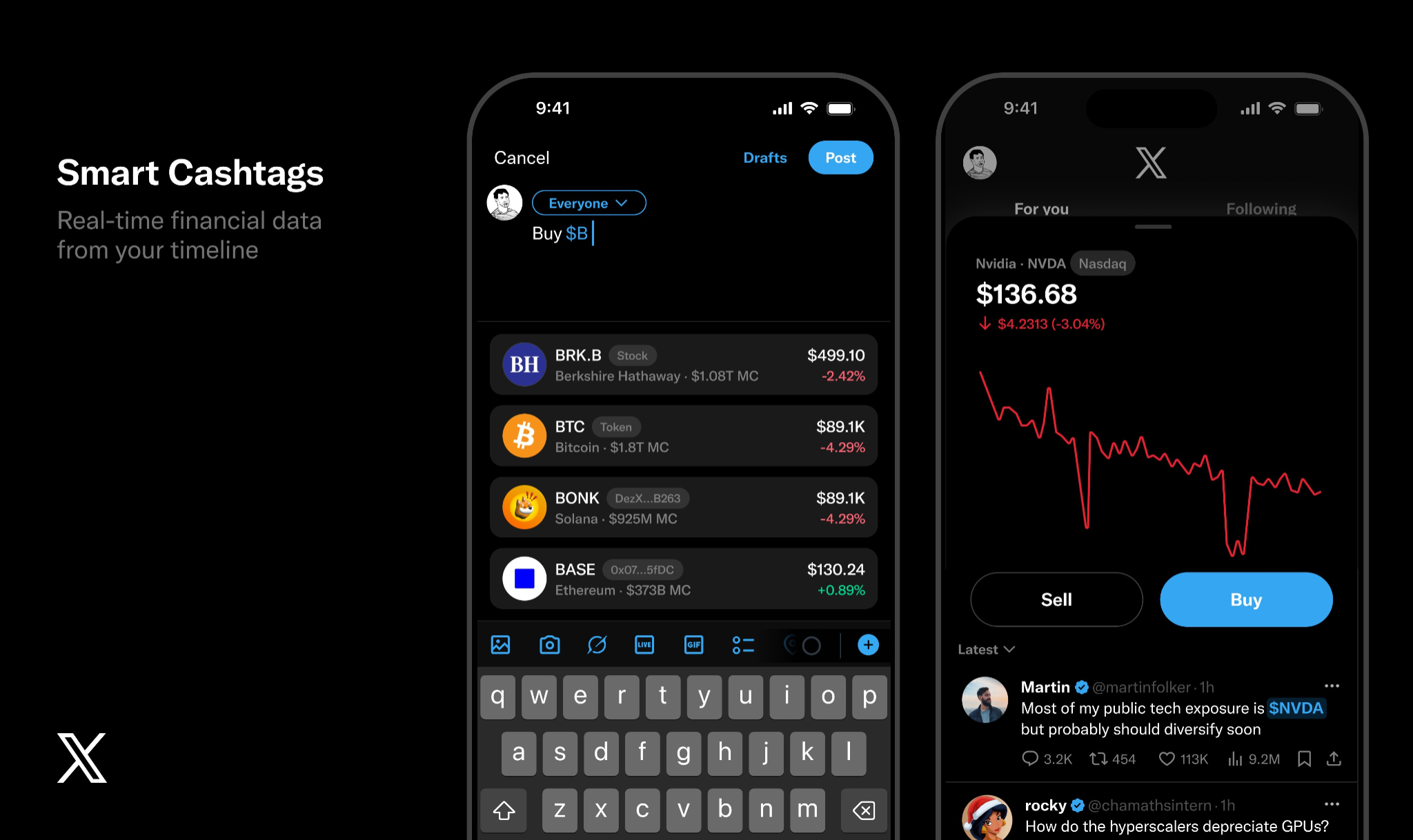

At the center of the rollout sits a feature called Smart Cashtags.

You see a ticker symbol in a post. You click. Financial data appears. Eventually, the trade can be executed.

X itself will not become a brokerage.

That would require an entirely different regulatory burden.

Instead, X will control the interface while routing execution to firms like Robinhood, Interactive Brokers, or Fidelity Investments for equities, and platforms like Coinbase, Kraken, and decentralized exchanges like Uniswap or Aerodrome for crypto.

The leverage is upstream: if the trade begins inside the timeline, X captures engagement, data, and revenue share—without carrying the balance-sheet risk of settlement.

The model resembles how crypto wallets like Metamask have handled tokenized stocks: interface on one side, regulated execution on the other.

Speculation swirls, as it always does, around which companies or crypto assets might be integrated directly.

One thing we do know: X already confirmed a partnership with Polymarket to surface live prediction-market data alongside posts and trends.

Why This Matters

Microsoft didn’t build every application. It built Windows.

Bloomberg doesn’t trade the markets. It sits on every trading desk.

Shopify doesn’t manufacture products. It powers the storefront.

X isn’t becoming a bank.

It’s positioning itself as the layer through which banking is accessed.

If you own:

- The social graph

- The wallet

- The trading interface

- The data layer

- The prediction layer (Polymarket integration)

You sit above banks without technically being one.

Control settlement and you challenge institutions. Control the screen? You shape the market itself.

Musk is going after the latter.

And that—even more than terawatts or titanium—is where the action is in 2026.

More to come.